From the Fall 2017 Issue

Energy Retrofits:

Lower Your Operating Costs Through Debt-Free Financing

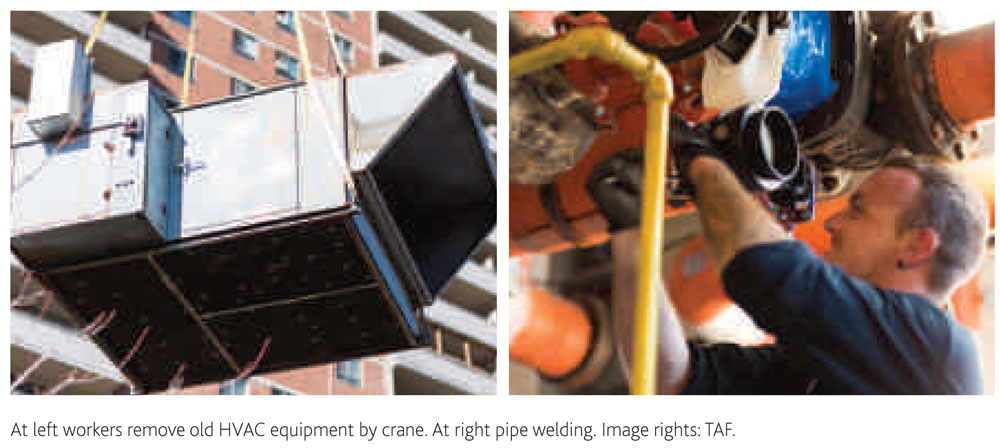

Newly installed high-efficiency boilers at a Toronto Community Housing Corporation project financed by The Atmospheric Fund. Project: Trethewey and Kendleton retrofits

No surprises – that’s how you can sum up what most building operators want when it comes to operating costs. But with challenging hydro prices and increasingly frequent extreme weather events, out-of-control electricity and gas expenses create headaches for many condo corporations in Ontario, especially since utility costs are the single largest, controllable expense for most buildings. So how can you bring down consumption and, with it, utility costs in your building?

The Case for Energy Retrofits is Clear

Appealing to residents to be mindful about their energy and water consumption is one route, individual metering another. But to truly lower your building’s electricity and gas usage, you need energy efficiency retrofits. This encompasses a wide range of measures, from superefficient common area lighting to upgrading hot water boilers that can cut your utility bills by 15-30 per cent. Savings can also come from reduced water consumption. Bonus: through improved indoor air quality, better lighting, etc. your building becomes more comfortable, too.

The data is clear: with current electricity and gas prices, investments that increase a building’s energy efficiency pay off handily. But despite the positive Return on Investment (ROI), many condo corporations hesitate to undertake energy retrofits. It’s not hard to see why: as upfront investments are needed, few condo corporations have the cash in hand to finance them without taking out a loan or digging into a building’s reserve fund – both steps that many condo boards are eager to avoid.

A New Way to Finance Retrofits – Debt-Free

This lack of action isn’t just hurting condo corporations as they face evergrowing energy costs. It’s also hurting our climate as a third of Ontario’s carbon emissions stem from buildings. This is where The Atmospheric Fund (TAF) comes in. As a non-profit corporation, our mission is to lower carbon emissions in the Greater Toronto and Hamilton Area (GTHA), home to half of Ontario’s population and Canada’s fastest-growing urban area

To help building operators get access to capital and increase energy efficiency TAF has developed an innovative approach called Energy Savings Performance Agreement (or ESPA™ for short). This non-debt financing tool is based on a simple concept: TAF pays for your energy retrofit, you split the savings.

The ESPA™ is a service agreement between TAF and a building owner. It’s a performance contract, not a loan. When you enter into an ESPA, TAF will pay directly for a suite of energy efficiency measures and technologies for your building. TAF then shares in the savings until TAF’s investment plus a return is earned back. It’s that simple.

Performance Contracting: Here’s How It Works

Let’s take a look at the different project steps:

- A qualified engineering firm will undertake an energy audit on the building and recommend specific energy efficiency measures.

- TAF pays for up to 100 per cent of the costs of retrofitting the building, and retains ownership of the equipment throughout the ESPA term.

- You as the building operator share the verified utility cost savings with TAF until your financing is repaid. Even in the unlikely case that the retrofit underperforms, your payment obligation is limited to the actual savings, so no additional cost is incurred.

- Once the term expires, you keep 100 per cent of the savings. Because your payments to TAF are entirely contingent upon savings, there’s no need to record an asset or obligation on your balance sheet.

This innovative financing tool is a great way for building operators to replace aging equipment, improve building comfort, reduce exposure to rising energy costs, and reduce carbon emissions — all with virtually no financial risk.

Performance Contracting Success Stories

The ESPA model is proven to work. Since 2012, TAF has entered into seven ESPAs in the Toronto region with a net combined investment value of $6.1 million. Project partners range from non-profits such as the Harbourfront Centre and the YMCA to condos and housing co-ops. Savings come from reduced gas and water consumption, not just lowered electricity usage.

All of our ESPAs to date are performing strongly, with energy and cost savings typically between 15 and 30 per cent. TAF’s investment volumes for these projects range from $116,000 to $2 million, with a median ESPA volume of $352,000.

TAF is experienced in financing retrofits for buildings that range from townhomes to high-rises. For example, TAF financed energy retrofits worth $2,000,000 at an 11-storey condo high-rise in Toronto. The building reported verified savings of $329,000 in the first year alone. Here are some other highlights:

Through a multi-measure energy retrofit at a 13-storey Scarborough housing co-op, TAF is bringing down utility costs and emissions by 17 per cent. Valued at $352,000, the retrofits include a new building automation system, high-efficiency common area lighting, voltage optimization, and a valve to eliminate excess water pressure.

Under a similar ESPA, TAF is financing retrofits at a housing co-op in Toronto’s west end that will save 33 per cent or 109 tonnes of carbon emissions annually. The retrofit measures included a domestic hot water condensing boiler, programmable thermostats in the units, weather stripping and air sealing, and an air-cooled variable refrigerant flow (VRF) system for the lobby.

Conclusion

Growing energy expenses mean that many building operators and condo boards face pressure to increase maintenance fees. Retrofits can help you lower your costs and make your condo building more attractive for owners and potential buyers. For the debt-free route, an ESPA might be the right fit. Other institutions like Energy Efficiency Corporation now also offer this financing tool.

Retrofitting your building – regardless of the financing you choose – will aid your bottom line and our shared climate.

Tim Stoate is Vice President, Impact Investing at The Atmospheric Fund. With nearly 30 years of experience in corporate finance, Tim oversees TAF’s impact investing and designs and tests new financing options that support low-carbon solutions. Tim focuses on structuring capital funding for energyefficient retrofits in the highrise residential/ condominium sector and the MASH (municipalities, academic institutions, school boards, and health and social service providers) sector. Taf.ca